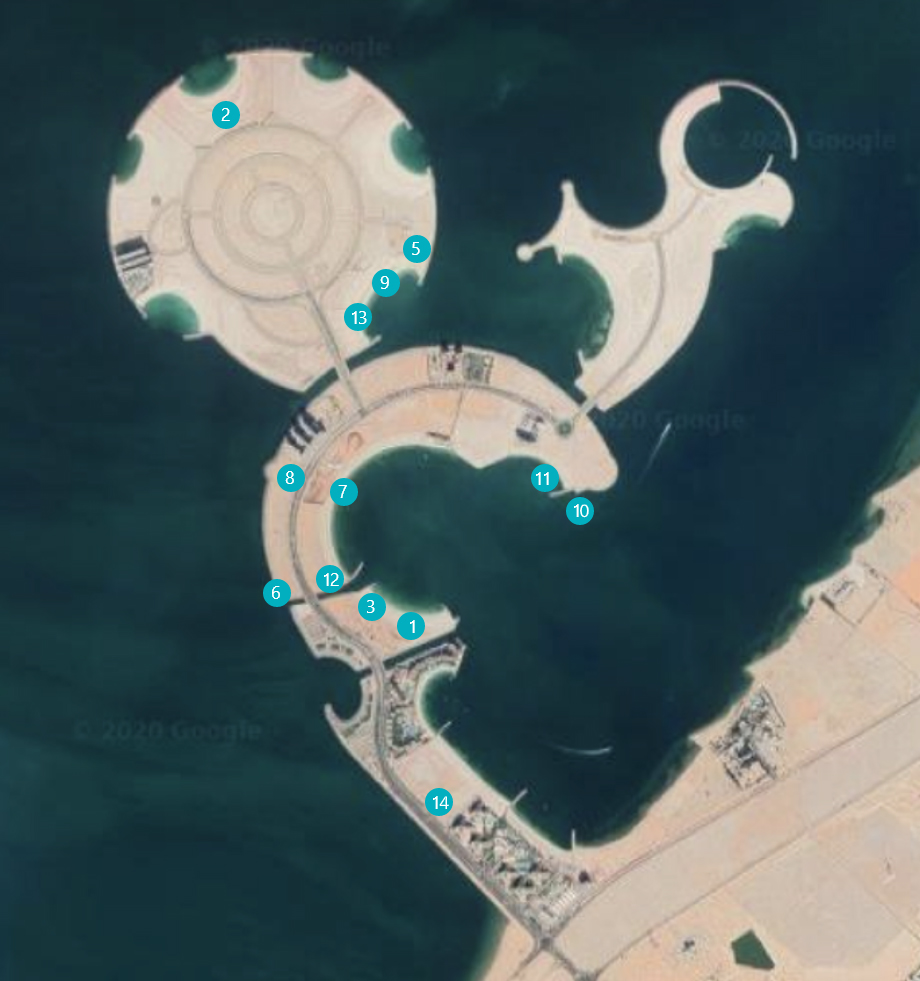

Rixos Bab Al Bahr 647 keys

Marjan Island Resort & Spa 299 keys

Bab Al Bahr Residences 512 units

Bab Al Bahr Residences 512 units

Double Tree by Hilton 723 keys

Movenpick

Address RAK

Rove Al Marjan Island

Radisson

Al Mahra Resort

Saudi German Hospital

Hampton by Hilton

Uniestate Living Bay

Avani Hotels

Hotel Resorts

Supercasa Hotel

Conrad Hotels

Movenpick

Barcelo Hotel Group

TURNKEY PROJECTS

LAND SALE

Land sale on Al Marjan Island for a variety of uses, including:

- Hospitality

- Mixed use

- Residential

- Retail

- Leisure

Land sale with pre-approved operator offering incentives such as operating profit guarantees over an extended period

Healthcare/wellness

Staff accommodation

Ticket size:

USD 5 – 10 million

TURNKEY INVESTMENT

Rove Hotel

441-key, 3-star beachfront hotel on Al Marjan Island

Developer-provided, minimum operating profit guarantee of 7% over 7 years

Barcelo Hotel

602-key, 5-star beachfront hotel on Al Marjan Island

Developer-provided, minimum operating profit guarantee over 10 years

Ticket size:

USD 80 – 160 million

JV’s & FINANCING

JV structure with:

Hotel operator

Retail operator

Ticket size:

Over USD 10 million

DEVELOPMENT MANAGEMENT SERVICES

Development management of a real estate project on behalf of clients like hotel operators and owners, and high-net-worth individuals.

Fees: 3 – 5% of

construction budget

ESTIMATE OF POTENTIAL RETURNS FOR A

HYPOTHETICAL 200-KEY HOTEL INVESTMENT

Al Marjan Island |

Palm Jumeirah |

Saadiyat Island |

|

|---|---|---|---|

| Occupancy (%) |

|

|

|

| Average daily rate (USD) | 210 | 300 | 232 |

| RevPAR (USD) | 151 | 240 | Sweden |

| Profit conversion (%) |

|

|

|

| Site acquisition and construction cost (‘000 USD) |

68,065 | 87,602 | 71,485 |

| Equity IRR (%) |

|

|

|

70%

Over 70%occupancy

$175

ADR$123

RevPARSource: Colliers International, RAK – Emirate of Opportunity Study, 2019

Wellness Resort

| Sample land area: | 1 SqFt |

| Floor area ratio: | 0.32 |

| GFA: | 0.32 |

| Land price: | USD 95 per SqFt (Land) |

| Construction cost: | USD 205 per SqFt (GFA) |

| Soft cost: | 8.00% of construction cost |

| Opex to revenues: | 55% of revenues |

| Exit cap rate: | 9.00% |

Stabilized

performance

KPIs

Occupancy

70%

ADR

USD 367

Other revenues

105% of room rev.

Return of investment

16.00%

Project IRR

17.00%

Payback period

9 - 10 years

Cash flow is based on USD per SqFt of land

| Project cash flow USD MN |

Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Year 6 | Year 7 | Year 8 |

|---|---|---|---|---|---|---|---|---|

| Revenues | 54 | 55 | 57 | 58 | 60 | |||

| Opex | (30) | (30) | (31) | (32) | (33 | |||

| Land Cost | (67) | (29) | ||||||

| Construction Cost | (20) | (20) | (13) | (13) | ||||

| Professional Fees | (4) | (1) |

Serviced Apartments

| Sample land area: | 1 SqFt |

| Floor area ratio: | 2.75 |

| GFA: | 2.75 |

| Land price: | USD 95 per SqFt (Land) |

| Construction cost: | USD 122 per SqFt (GFA) |

| Soft cost: | 8.00% of construction cost |

| Opex to revenues: | 55% of revenues |

| Exit cap rate: | 9.00% |

Stabilized performance KPIs

Occupancy 70%

ADR USD 177

Other revenues 30% of room rev.

Return of investment

16.00%

Project IRR

22.00%

Payback period

9 - 10 years

Cash flow is based on USD per SqFt of land

| Project cash flow USD MN |

Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Year 6 | Year 7 | Year 8 |

|---|---|---|---|---|---|---|---|---|

| Revenues | 187 | 192 | 197 | 202 | 207 | |||

| Opex | (103) | (106) | (108) | (111) | (114) | |||

| Land Cost | (67) | (29) | ||||||

| Construction Cost | (101) | (101) | (67) | (67) | ||||

| Professional Fees | (22) | (5) |